Sir William Castell: championing Norway’s pioneers of ultrasound contrast media

These advancements came in tandem with the increasing popularity of ultrasound contrast agents used to enhance imaging capability. In this fast-moving environment, the Norwegian medical ultrasound ecosystem was making a name for itself [1].

This caught the attention of Sir William Castell, then CEO of UK-based radiopharmaceutical company Amersham International plc, as did Norwegian Nycomed’s pioneering work in the field of medical contrast media.

Castell boldly envisioned that integrating Nycomed’s business with Amersham’s would make them leaders in the field of in vivo diagnostic imaging agents. His ambitious bet paid off. When the combined entity Nycomed Amersham was acquired by GE for almost USD 10 billion a few years later (2004), the company – with Castell at the helm – did indeed become the global leader in diagnostic imaging agents.

Building a global brand in ultrasound contrast media

In the mid-1970s Nycomed stood out among its peers in the Norwegian pharmaceutical industry, having grown organically from an import agent for pharmaceutical products 100 years earlier to manufacturing its own pharmaceuticals. It reached its first R&D breakthrough in the budding field of X-ray contrast media.

By the early ‘90s, Nycomed’s imaging operations had grown to 1 250 employees and were reaching an inflection point where further growth may have proven harder organically than through acquisition. Similarly, Castell understood very well that a strategy of organic growth can be slow-paced and not always the best way to create a global brand.

He recalls: “When I joined Amersham in 1989 it was a medium-sized company with around 3 000 staff and assets of GBP 100 million. I wrote our new business strategy in my first six weeks. The Chernobyl nuclear disaster was fresh in everyone’s minds, so I was concerned that radioactive isotopes would no longer be a commercially acceptable product.”

“I was keen on expanding our product base into non-radioactive areas to spread our risk across different product bases. I still have the piece of paper I wrote this plan on. It was a simple strategy, but it took eight years of hard work.”

He therefore turned his gaze towards other key players in the sector outside radioactive isotopes, which led him to the Norwegian shores. After several years of complex negotiations, the diagnostic division of Nycomed Imaging merged with Amersham International Plc in the summer of 1997. As the architect of this merger, Castell gave the combined group a world-leading 30 per cent share of the market for in vivo imaging agents and formed Nycomed Amersham plc, a global corporation with annual revenues of USD 2.5 billion [2].

“We were very proud of the fact that the Nycomed Amersham group was now global in sales and had an enormous volume of its research based in Northern Europe. That was how we moved into microbubbles and contrast media research, which gave us a global business,” explains Castell.

Microbubbles and ultrasound to deliver therapeutic payloads

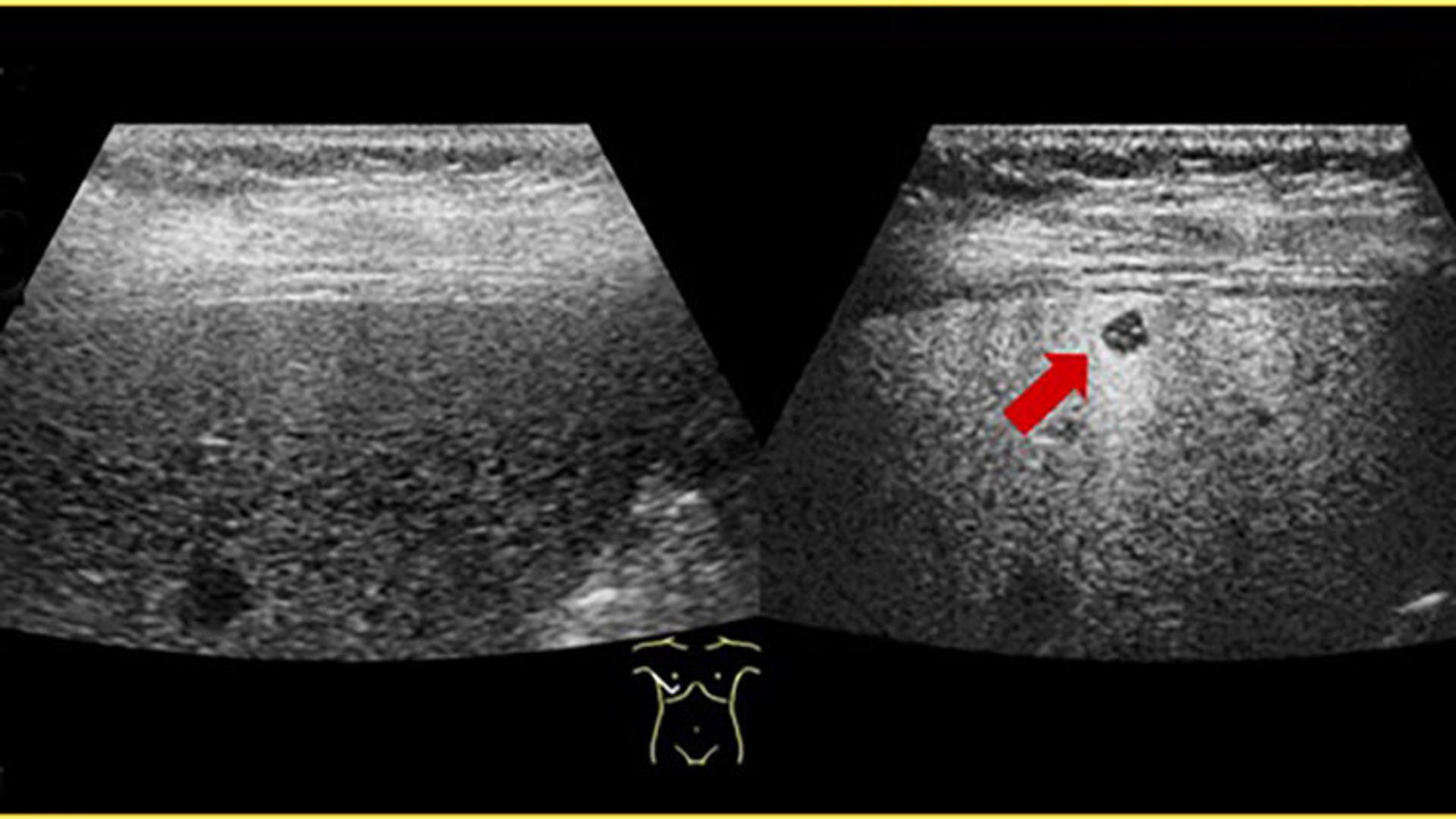

Nycomed Amersham was aware not only of ultrasound’s diagnostic capabilities but also of its potential use as an innovative method for therapeutics. As early as 1997, Dr Sanjiv Kaul and his team at the cardiovascular division of the University of Virginia hypothesised that “drugs and genetic material could be delivered to tissue by way of microbubbles that could then be destroyed with ultrasound at the required site, providing a means of efficient local delivery” [3].

This exciting concept caught Castell’s attention and the Norwegian ultrasound contrast media experts’ imagination, and they became very focused on how they could develop ultrasound as a tool for drug delivery.

Today, technologies based on ultrasound contrast media are in clinical development for drug delivery and therapeutic enhancement and show great promise in cancer therapy. Castell reflects on the journey of progress so far:

“I think it’s really interesting how long it takes to achieve these things. The fact that we have established a safety profile for ultrasound has been vital for this new journey into therapeutics. We continue to develop better probes to a sophistication level that will give us confidence in the clinical setting and enable a navigational technique to locate tumours, allowing clinicians to see precisely where they are delivering a drug.”

“It’s important not to lose sight of all these advancements we have made since we began 26 years ago. The progress is slow but eventually it compounds towards an enormous change. We already know we can deliver targeted drugs to the body using ultrasound, the next step is to discover exactly how we can refine that delivery.”

“On the cusp of spectacular change”

By 2019 contrast agents originating from Nycomed Amersham’s products were used in more than 100 million procedures a year across multiple imaging modalities. This is equivalent to three patients being injected every second [4].

Today, the Norwegian-born contrast agents Optison and Sonazoid™ are part of GE Healthcare’s global offering and make up two of the four commercially approved microbubbles for ultrasound diagnostics imaging.

Moreover, during the COVID-19 pandemic, contrast enhanced ultrasonography became the technology of choice to help to measure lung damage, even during asymptomatic phase of the virus [5,6]. This sudden increase in global demand for lung ultrasonography procedures has fuelled further investments in the field of ultrasound contrast agents. In 2021, the global contrast enhanced ultrasound market size was valued at USD 2.4 billion [7,8].

“We are on the cusp of spectacular change, as genomics, imaging, diagnostics, data analysis and other technologies come together to make real precision medicine possible for the first time,” Bill Castell concludes [9].

Spotlight on Norwegian ultrasound industry

This article was written by Leah Anderson on behalf of EXACT-Therapeutics AS, Innovation Norway, Norway Health Tech, Investinor AS and the Centre for Innovative Ultrasound Solutions (CIUS). The article is part of the series “The global reach of Norwegian ultrasound innovation”, which focuses on how Norwegian ultrasound innovation is impacting medicine globally.